When unexpected events force you to cancel your cruise plans, Carnival Travel Protection could be the difference between losing thousands of dollars or getting a full refund. Yet many travelers purchase this coverage without understanding exactly what’s included, only to discover too late that their specific situation isn’t covered. With cruise vacations representing significant financial investments, knowing the right questions to ask about Carnival’s protection plan is critical for safeguarding your trip.

While comprehensive details require consultation with Carnival’s official resources, this guide focuses on the essential evaluation framework you need before deciding whether Carnival Travel Protection aligns with your travel needs. You’ll learn the specific questions to ask, documentation requirements to understand, and common pitfalls that could leave you unprotected when you need coverage most.

What Carnival Travel Protection Typically Covers (And Where It Falls Short)

Trip Cancellation: The Core Benefit You Must Understand

Trip cancellation coverage represents the primary reason most travelers purchase protection, yet misunderstanding what qualifies as a “covered reason” leads to many claim denials. Standard travel protection plans generally cover cancellations due to sudden illness, injury, death of an immediate family member, or job loss—but Carnival’s specific definitions of these terms determine whether your claim will be approved.

Before purchasing, ask Carnival specifically: “What medical documentation do you require to validate an illness-related cancellation?” Many travelers assume a doctor’s note suffices, but some plans require hospital admission records or specific diagnostic codes. Knowing these requirements upfront prevents claim denials when you’re already dealing with a health crisis.

Medical Coverage Abroad: Why Your Regular Insurance Isn’t Enough

Cruise medical emergencies present unique challenges since your standard health insurance likely provides minimal coverage outside your home country. Carnival Travel Protection typically includes medical coverage for onboard emergencies and port visits, but coverage limits vary significantly between plans. Some basic plans offer only $50,000 in medical coverage, while comprehensive options may provide $500,000 or more.

Ask this critical question before sailing: “What’s the exact medical evacuation coverage amount in your plan?” Emergency evacuations from cruise ships can cost $100,000 or more, and inadequate coverage leaves you personally liable for these extraordinary expenses. Don’t assume standard plans provide sufficient evacuation coverage—verify the specific dollar amount.

Trip Interruption vs. Delay: Understanding the Critical Difference

Most travelers don’t realize trip interruption and trip delay represent separate coverage categories with different requirements. Trip interruption applies when you must end your cruise early for a covered reason (reimbursing unused cruise days), while trip delay covers additional expenses when your journey to the ship is delayed (like hotel stays during flight cancellations).

The distinction becomes crucial when unexpected events occur. If your connecting flight gets canceled the day before embarkation, trip delay coverage would apply—but only if your specific reason for delay (weather, mechanical issues, etc.) is explicitly covered. Request Carnival’s written definition of covered trip delay reasons before purchasing, as “weather” may only include severe storms, not routine delays.

How Carnival’s Pricing Works (And When You’re Overpaying)

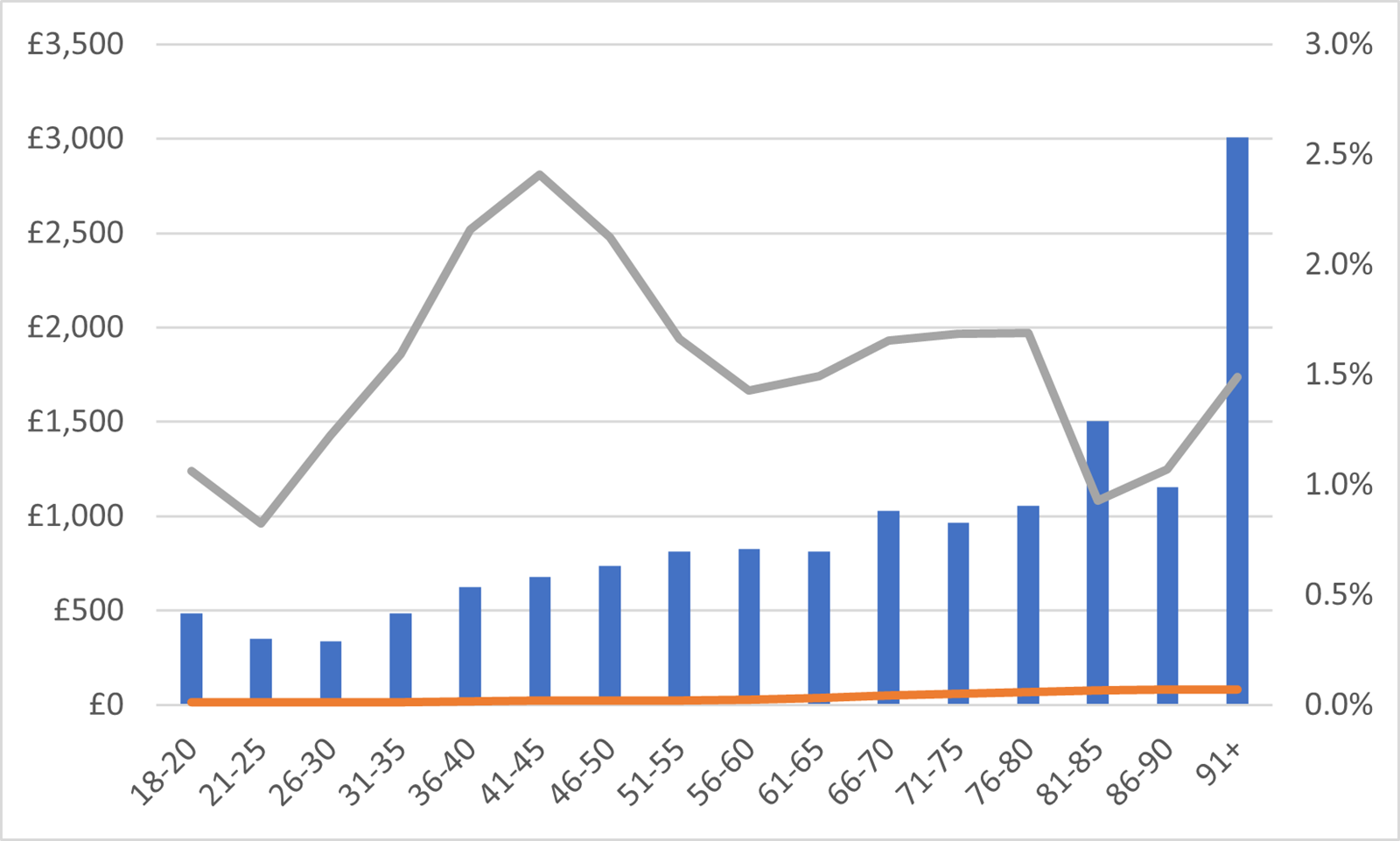

Age-Based Premium Increases You Can’t Ignore

Carnival Travel Protection pricing typically ranges from 8-12% of your total cruise fare, but travelers over 65 often face significantly higher premiums due to increased medical risk. Some plans effectively double in cost for seniors, making third-party options potentially more economical.

Calculate whether Carnival’s convenience justifies the premium by asking: “What’s the exact cost for travelers in my age bracket?” Many travelers qualify for third-party plans at lower rates with equivalent or better coverage. Don’t accept vague percentage ranges—get the specific dollar amount based on your age and cruise cost.

Family Coverage Pitfalls That Cost You Money

Family coverage structures vary significantly between providers. Some plans automatically include children under 18 at no additional cost when traveling with insured parents, while others charge per person regardless of age. Carnival’s specific family policy determines whether you’re getting value or overpaying.

Before finalizing your booking, clarify: “Does your plan cover all family members traveling together under one policy, or do we need separate policies for each person?” This question prevents unpleasant surprises when reviewing your final invoice and helps you accurately compare costs against third-party options.

The Refund Deadline Most Travelers Miss

Protection plans purchased through Carnival typically become non-refundable after final payment, but you can usually cancel the protection itself before that deadline without penalty. This creates a strategic window where you can compare third-party options after booking but before final payment.

Mark your calendar for this critical date: “What’s the exact deadline to cancel the protection plan without penalty?” This information allows you to secure your cruise booking while still maintaining flexibility to shop around for better coverage options before the final payment due date.

Navigating Carnival’s Claims Process Successfully

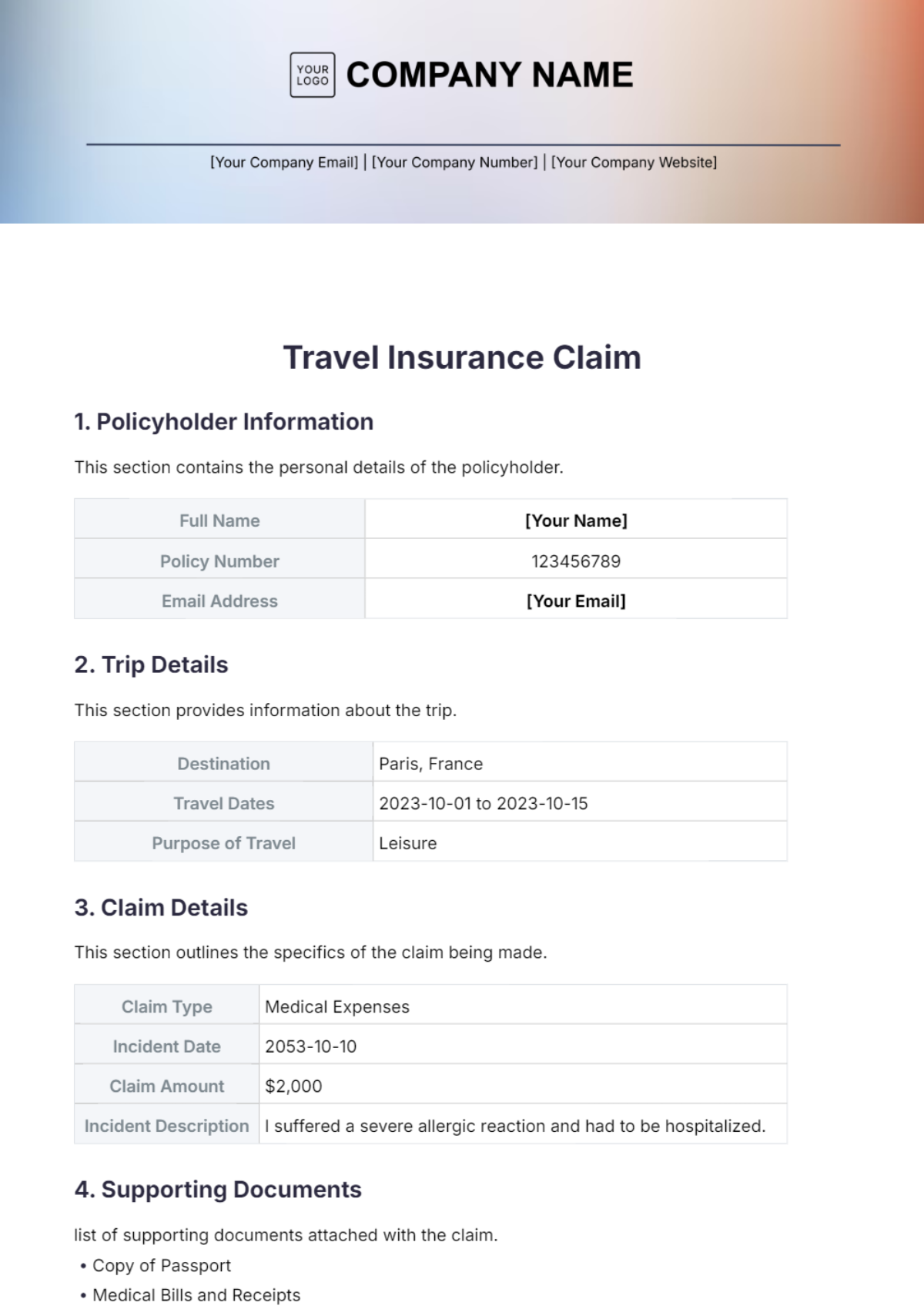

Documentation Requirements That Make or Break Your Claim

Successful claims depend entirely on submitting the correct documentation. Medical claims typically require more than just a doctor’s note—they often need hospital admission records, treatment plans, and physician statements linking your condition to the inability to travel.

Get specific before you need to file: “What exact documents do you require for a medical cancellation claim?” Request a written checklist of acceptable documentation types. Many claims get denied because travelers submit insufficient paperwork, not because their reason wasn’t covered.

Pre-Existing Condition Deadlines That Can’t Be Missed

Most travel protection plans waive pre-existing condition exclusions only if purchased within 14-21 days of your initial cruise deposit. Missing this window could invalidate coverage for chronic conditions, recent surgeries, or ongoing treatments that later force cancellation.

Confirm this critical timeline: “What’s your exact deadline for purchasing coverage to waive pre-existing conditions?” Don’t assume it’s 14 or 21 days—Carnival’s specific policy determines whether your health history affects coverage. Set a calendar reminder for this deadline immediately after making your deposit.

Processing Timeframes That Affect Your Next Steps

Understanding claim processing times helps manage expectations after submitting documentation. Most travel insurance claims process within 30-45 days, but complex medical cases can take 90 days or longer, especially if additional documentation is requested.

Ask this practical question: “What’s your average processing time for medical cancellation claims?” Knowing the typical timeframe prevents unnecessary follow-ups and helps you plan financially if you’re waiting on reimbursement to fund alternative travel arrangements.

Smart Comparison Shopping Strategies

Carnival vs. Third-Party: The Value Proposition Breakdown

https://www.comparetravelinsurance.com/carnival-vs-allianz-vs-world-nomads-comparison

Carnival’s protection offers convenience—you purchase during booking and everything integrates with your reservation—but third-party providers often offer broader coverage at lower costs. The key difference frequently lies in “cancel for any reason” (CFAR) options, which basic Carnival plans typically don’t include.

When comparing options, focus on this metric: “What’s the maximum percentage of my cruise cost covered under your plan?” Some third-party plans cover 100% of non-refundable costs, while basic Carnival plans might only cover 75-80%, creating significant financial exposure.

The Hidden Value of Carnival’s Integrated Services

Carnival Travel Protection may offer unique advantages beyond standard coverage, including direct coordination with shipboard medical staff and priority rebooking assistance if your cruise gets canceled. These conveniences become valuable when dealing with complex situations while traveling.

Determine if these benefits justify potential cost differences by asking: “What specific services do you provide that third-party insurers don’t?” For frequent Carnival cruisers, the streamlined claims process and direct integration with Carnival’s systems might outweigh slightly higher premiums.

Coverage Gap Analysis: Protecting Your Entire Investment

Your total travel investment includes more than just the cruise fare—airfare, pre-cruise hotels, shore excursions, and other non-refundable expenses also need protection. Carnival’s plan might cover only the cruise portion, leaving other significant expenses exposed.

Create a complete picture by asking: “Does your coverage extend to pre-paid shore excursions and airfare booked through Carnival?” If not, you may need supplemental coverage for these substantial expenses that basic plans often exclude.

Making Your Informed Decision

Choosing Carnival Travel Protection requires careful evaluation of your specific circumstances rather than a one-size-fits-all approach. Start by calculating your total non-refundable investment, then research the exact coverage details directly from Carnival’s official resources. Remember that the cost of protection (typically less than $200 for most cruises) often pales compared to losing thousands in cruise fares due to unexpected cancellations.

The most critical step happens before purchase: read Carnival’s full policy wording, not just the marketing summary. Focus specifically on covered reasons for cancellation, medical coverage limits, and pre-existing condition requirements. If anything remains unclear, call Carnival directly and request written clarification—verbal assurances from booking agents may not reflect actual policy terms.

Never purchase travel protection based on pressure or incomplete information. You typically have until final payment to add coverage without penalty, giving you time to compare options and make an informed decision. Your future self—facing a medical emergency or family crisis—will thank you for taking this extra step to ensure your coverage actually matches your needs.

Final Note: This guidance provides general information about evaluating cruise travel protection based on standard industry practices. Carnival Cruise Line’s specific Travel Protection terms, conditions, pricing, and coverage details may vary by sailing date, region, and other factors. Always consult Carnival’s official policy documentation and speak directly with Carnival representatives to verify current coverage details before purchasing. Travel protection plans are subject to change without notice, and only the official policy wording governs coverage. Do not rely solely on this information when making purchasing decisions—verify all details through Carnival Cruise Line’s official channels.