Your sales team just booked five flights to Chicago next month, and you’re about to pay full price while competitors fly for free using smart travel rewards strategies. For small businesses where every dollar counts, the right travel rewards program can transform routine expenses into valuable perks, free trips, and significant cost savings. Unfortunately, most small business owners select programs based on flashy sign-up bonuses rather than matching their actual spending patterns—leaving thousands in unclaimed rewards on the table each year.

The difference between average and exceptional travel rewards programs comes down to one critical factor: alignment with your specific business operations. Instead of chasing the biggest bonus offer, focus on how your team actually spends money and travels. This guide reveals the exact process successful small businesses use to identify, evaluate, and implement travel rewards programs that deliver real ROI—not just theoretical points. You’ll learn how to analyze your spending data, compare program structures against your actual needs, and avoid common pitfalls that turn promising rewards into frustrating dead ends.

Airline vs. Bank vs. Hotel Rewards: Which Program Type Fits Your Business Travel?

Flexible Points Systems That Maximize Your Redemption Options

Bank-issued travel cards like Chase Sapphire Business or American Express Business Gold provide unmatched flexibility through transferable points systems. These programs let you move points to 10+ airline and hotel partners, creating a safety net against devaluation while expanding your redemption options. If your team travels to multiple destinations with different airlines, this flexibility ensures you’ll always find available award seats without being locked into one carrier’s restrictive inventory.

Fixed-value points systems offer simplicity with predictable redemption rates—each point equals 1-1.5 cents toward any travel purchase. Programs like Capital One Spark Miles or Bank of America Business Advantage Travel Rewards eliminate the complexity of calculating point values across different redemption options. While you won’t score those aspirational first-class redemptions, you’ll never wonder whether you’re getting fair value for your points, making these ideal for businesses prioritizing straightforward accounting.

Airline-Specific Programs That Deliver Elite Status Perks

When your team consistently flies one airline—like Southwest between Dallas and Chicago or Delta along the East Coast—airline-specific programs become powerful tools. American AAdvantage or Delta SkyMiles reward frequent flyers with elite status that unlocks free upgrades, priority boarding, and dedicated customer service. These perks translate directly to productivity gains as your team spends less time waiting in lines and more time closing deals.

However, airline programs come with significant limitations. Award availability often requires booking 11+ months in advance for international business class, and blackout dates can derail last-minute travel plans. Before committing, test availability for your most common routes using both peak and off-peak travel dates. If you can’t consistently find award seats 3-6 months out, an airline-specific program might deliver less value than you expect.

Analyze Your Actual Spending: The Key to Maximizing Small Business Travel Rewards

Categorize Your Business Expenses for Targeted Rewards Selection

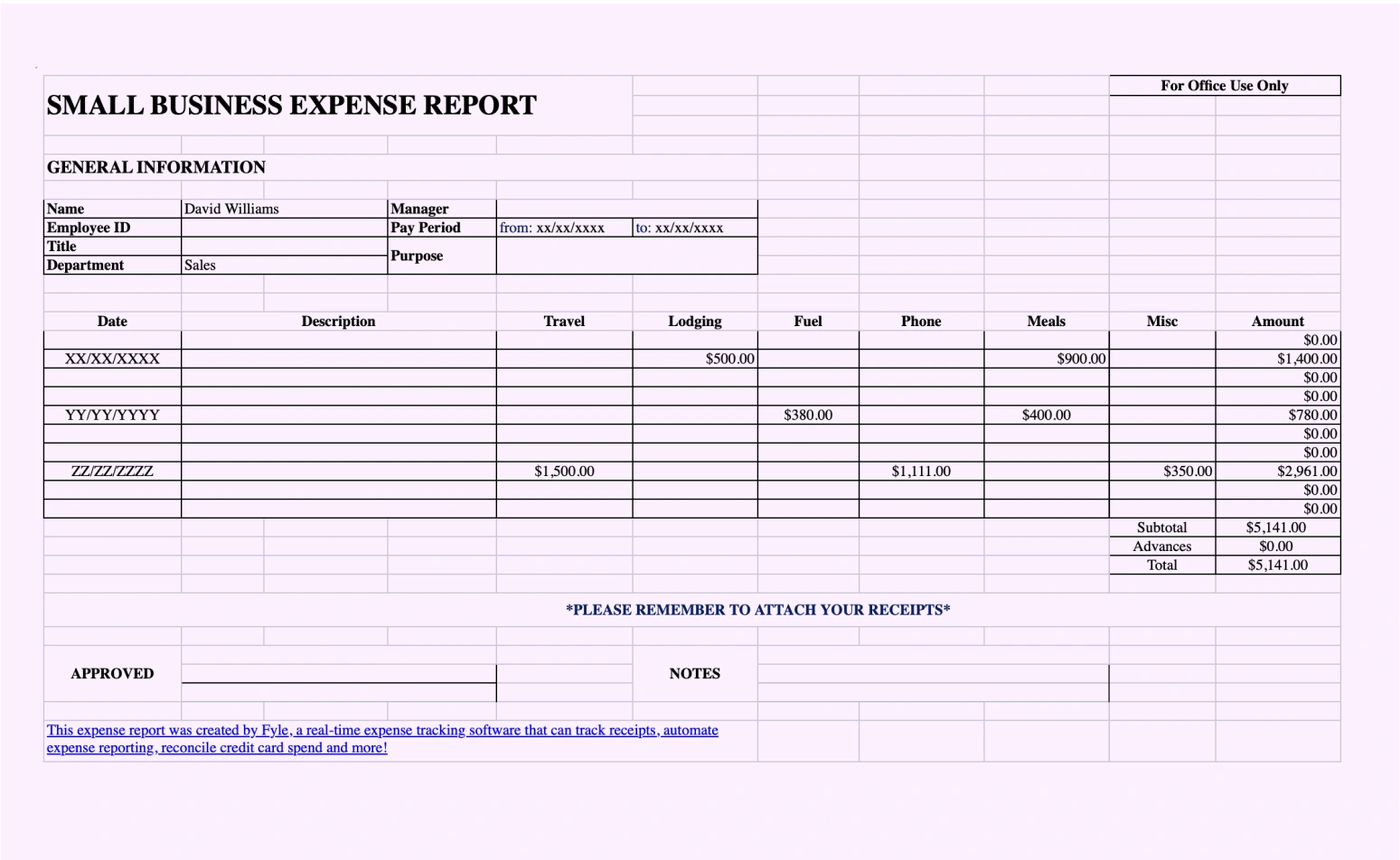

Start with three months of business credit card statements and categorize every purchase into specific spending buckets. Track travel expenses (flights, hotels, rental cars), office supplies, communications, advertising, dining, and gas separately. This detailed breakdown reveals where your money actually goes—information most business owners guess at but rarely verify.

A business spending $3,000 monthly on Google Ads should prioritize cards offering 3-4x points on advertising rather than 2x on dining. Similarly, if your team frequently dines with clients, a card with strong dining rewards makes more sense than one optimized for office supplies you rarely purchase. Your highest spending categories should directly determine which bonus structures deliver maximum value for your specific operations.

Map Your Team’s Travel Patterns Before Choosing Any Program

Document your team’s travel for the past year to identify patterns that should drive your program selection. Note which airlines serve your most common routes, which hotel chains dominate your destinations, and whether you typically book economy or business class. Track the number of hotel nights annually and the domestic versus international travel split.

This data transforms abstract program comparisons into concrete value calculations. A business flying exclusively between New York and London needs different rewards capabilities than one with domestic-only travel. If your team stays primarily at Hampton Inns, a program with strong Hilton Honors transfer options delivers more value than one focused on Marriott partnerships.

Calculate True Program Value: Beyond the Sign-Up Bonus Hype

Employee Card Benefits That Multiply Your Rewards Earning

Adding employee cards properly structured can triple your points earning without personal liability for employee spending. Most quality business programs offer free employee cards (5-99 additional cards), individual spending limits, centralized billing, and identical bonus earning rates for all cardholders. A 10-person sales team using company cards for travel and client meals significantly boosts your points accumulation compared to a single primary card.

Before selecting a program, verify the employee card structure. Some premium cards charge $175 per employee card, making them cost-prohibitive for growing teams. Others limit bonus categories to the primary cardholder. The best programs treat employee cards as full extensions of the primary account, maximizing earning potential across your entire organization.

Hidden Fee Analysis That Determines Net Program Value

Annual fees represent only the most obvious cost—many programs include hidden fees that significantly impact net value. Foreign transaction fees (2.7-3% on international purchases) can erase rewards value for businesses with global operations. Some premium cards charge fees for employee cards, and balance transfer fees (3-5%) add cost if you occasionally carry balances.

Create a simple ROI spreadsheet comparing programs using your actual data: annual spending by category, projected points earned, point value (1-1.5 cents), annual fee, and expected utilization of credits/perks. Subtract costs from projected rewards value to determine true net benefit. A $450 annual fee makes sense only if you earn $2,000+ in extra rewards and utilize $500+ in annual credits through statement credits, lounge access, or other perks.

Top Small Business Travel Rewards Programs Compared for Real-World Value

Chase Ink Business Preferred: Best for Advertising and Shipping Heavy Businesses

The Chase Ink Business Preferred earns 3x points on travel, shipping, internet/cable/phone, and advertising—perfect for businesses with significant digital marketing spend. Its 100,000-point sign-up bonus (after $15,000 spend in 3 months) translates to $1,250+ in travel, and the $95 annual fee disappears when you factor in $300 in annual travel credits. Most valuable for service businesses and agencies with high advertising expenses.

American Express Business Gold: Top Choice for Category Optimization

Amex Business Gold delivers 4x points on your top two spending categories from advertising, shipping, technology providers, and gas stations. The 90,000-point welcome bonus (after $10,000 spend in 3 months) plus $250 in annual credits offsets much of the $295 annual fee. This card shines when your business concentrates spending in just two bonus categories, making it ideal for consultancies with heavy advertising and software expenses.

Capital One Spark Miles: Simplest Solution for Undisciplined Spenders

With a flat 2x points on everything and no annual fee the first year ($95 thereafter), Capital One Spark Miles eliminates category management complexity. The 50,000-mile sign-up bonus (after $4,500 spend) provides immediate value, and the straightforward earning structure works well for businesses without disciplined spending patterns. While it lacks premium perks, its simplicity makes rewards accumulation accessible even for teams without strict category adherence.

Implement Your Chosen Program for Maximum Small Business Impact

Employee Training Protocol That Ensures Program Success

Set clear guidelines for which card to use for which purchases and establish spending alerts to catch mistakes early. Conduct monthly reviews to ensure employees use the correct cards for maximum points earning, and consider sharing points benefits with top users to incentivize proper usage. Without this structure, even the best program delivers subpar results as employees default to convenience over optimization.

Quarterly Optimization Process That Adapts to Business Changes

Review your program quarterly by tracking actual versus projected points earned, checking redemption rates achieved, monitoring fee utilization, and adjusting employee limits based on usage patterns. Your business evolves—your rewards strategy should too. Most small businesses make the mistake of setting up a program and never optimizing it, missing opportunities to adjust as spending patterns shift or new program features emerge.

The right travel rewards program for your small business isn’t the one with the biggest sign-up bonus—it’s the one that aligns perfectly with your actual spending and travel patterns. Start simple with one well-chosen program that delivers clear ROI based on your specific operations, then expand your strategy as you prove value. By focusing on your real business needs rather than marketing hype, you’ll transform ordinary business expenses into valuable travel perks that boost both your bottom line and your team’s productivity. Reassess your program annually to ensure it continues delivering maximum value as your business grows and evolves.